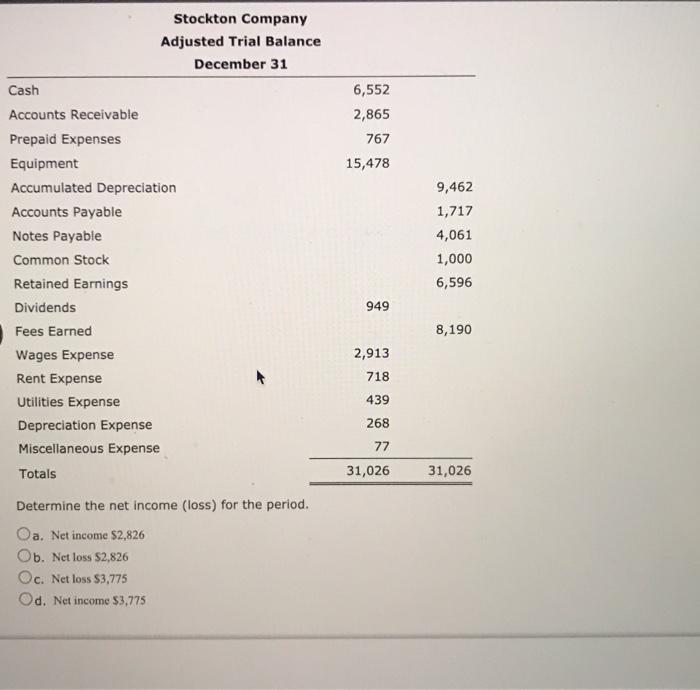

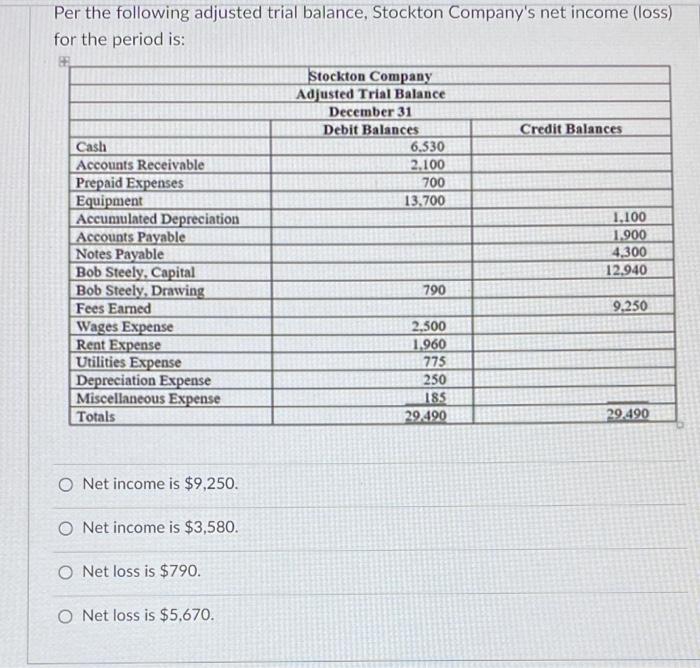

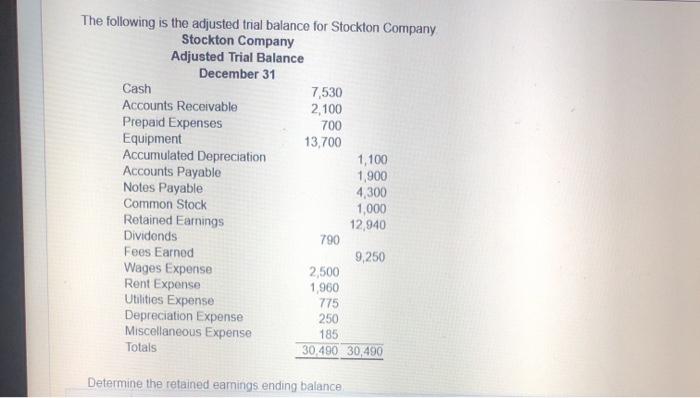

The following is the adjusted trial balance for stockton company. – The adjusted trial balance for Stockton Company serves as a critical component in the financial reporting process, providing a comprehensive overview of the company’s financial position at a specific point in time. This document plays a vital role in ensuring the accuracy and reliability of financial statements, facilitating informed decision-making and effective financial management.

Understanding the purpose, components, and limitations of an adjusted trial balance is essential for accountants, financial analysts, and business owners alike. This guide delves into the intricacies of this important financial tool, empowering readers with the knowledge and insights necessary to leverage its benefits effectively.

1. Introduction: The Following Is The Adjusted Trial Balance For Stockton Company.

An adjusted trial balance is a financial statement that summarizes the balances of all accounts in the general ledger after adjusting entries have been posted. It is a crucial step in the accounting cycle and provides a snapshot of the company’s financial position at a specific point in time.

Components of an Adjusted Trial Balance

- Unadjusted balances: The balances of all accounts in the general ledger before any adjusting entries have been posted.

- Adjusting entries: Transactions that are recorded to update the balances of accounts to reflect events that have occurred but have not yet been recorded.

- Adjusted balances: The balances of all accounts in the general ledger after adjusting entries have been posted.

Preparing an Adjusted Trial Balance

- Review the unadjusted trial balance and identify any necessary adjusting entries.

- Post the adjusting entries to the general ledger.

- Prepare a new trial balance that includes the adjusted balances.

Using an Adjusted Trial Balance

The adjusted trial balance is used to prepare financial statements, including the income statement, balance sheet, and statement of cash flows. It provides a basis for closing the accounting records and preparing the post-closing trial balance.

Limitations of an Adjusted Trial Balance, The following is the adjusted trial balance for stockton company.

While an adjusted trial balance is a valuable tool, it has certain limitations. It does not include all transactions that have occurred since the last financial statement was prepared, and it does not reflect the company’s cash flow position.

FAQ Summary

What is the purpose of an adjusted trial balance?

An adjusted trial balance is used to ensure the accuracy of financial statements by incorporating adjustments that reflect the company’s financial transactions and events that have occurred since the last reporting period.

How does an adjusted trial balance differ from an unadjusted trial balance?

An adjusted trial balance includes adjustments for accrued and deferred revenues and expenses, depreciation, and other items that are not reflected in the unadjusted trial balance.

What are the limitations of an adjusted trial balance?

An adjusted trial balance may not fully reflect the company’s true financial position due to factors such as unrecorded transactions, errors, or fraud.